Governance

Corporate Governance

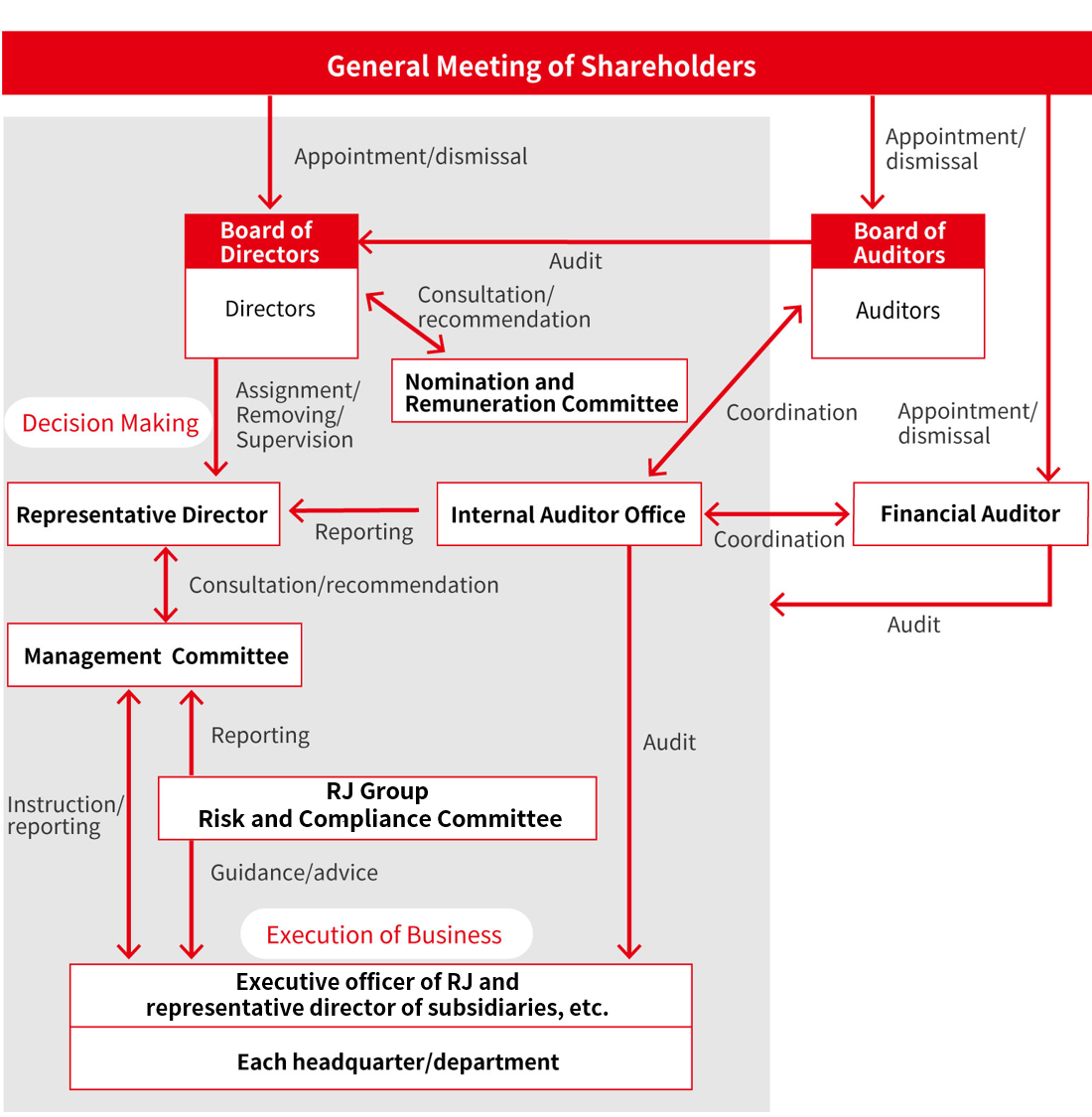

We recognize that enhancing management efficiency, soundness, and transparency and promoting corporate management that enables long-term, stable, continuous enhancement of stockholder value is fundamental for corporate governance and is an importance management issue.

We and our group companies also recognize that it is important to establish and implement a system for monitoring legal compliance as type II financial instruments business operators and investment advisory and agency business operators. Specifically, regarding the monitoring function, it is important that the legal department, and internal audit office monitor our operations and at the same time, the auditing officers fulfill their auditing function with adequate independence.

To improve corporate governance, we will develop a decision-making system that allows us to respond promptly, fairly, and reasonably to changes in the business environment and an internal system that enables efficient business operations. Meanwhile, through timely disclosure of management information, we maintain adequate transparency so as to be trustworthy from all stakeholders.

Governance structure diagram

Compliance

The structure for ensuring compliance with laws and the articles of incorporation in the execution of duties by our board directors and employees is shown below.

-

1We have established the standards of behavior for our officers and employees, based on which the compliance structure has been established, and our board directors are required to set an example so as to ensure that these standards are understood and observed by all employees.

-

2We, as a company with a board of auditors, will ensure compliance with laws in the execution of duties by board directors under an organizational structure with the supervision of the board of directors and the auditing of the board of auditors.

-

3We have established a legal department and will promote the development and implementation of our compliance system so as to ensure that there are no violations of law or other compliance violations, and will respond promptly to violations of law or other compliance violations should they occur.

-

4We have established compliance guidelines to ensure that all officers and employees understand what laws and regulations they must observe and raise their compliance awareness.

-

5We will develop and implement a whistle-blowing system so as to prevent and detect violations of laws and standards of behavior by officers and employees as quickly as possible and if such a violation or other serious problem occurs, convene a disciplinary committee and fairly determine what penalty to impose according to the employment regulations.

-

6We have established a basic policy concerning the handling of antisocial forces and take a firm attitude against antisocial forces posing a threat to the order and safety of society and will never have connections with these forces, including business connections.

Matters to Be Noted for Financial Instruments Exchange, etc.

Basic Policy against Anti-social Forces

Basic Policy on Compliance